While parts of Europe are tentatively dipping their toes into a lighter form of a lockdown, with Austria planing to reopen businesses from next week and Denmark restarting schools, the pandemic is claiming a much higher toll in the US.

Given that the US is a little bit behind Europe on the virus spread curve, next week’s US oil and economic data will carry more weight than usual as it will very quickly provide an insight in how badly the ravaging of the coronavirus is affecting the domestic oil market.

Saudi Arabia and Russia have temporarily buried their hatchets, under duress, and together with other OPEC members agreed to cut production by 10m/bbl a day.

Though the decision has been a long time coming, the size of the cut will only make a dent in the declining oil price given that global demand has dropped by more than 30% since the start of the pandemic.

Some smaller European countries are talking about a slight easing of lockdown rules but to put it into perspective, they have already said that they will keep their borders closed and not allow international travel and holidays until there is a vaccine.

This means that the two main strands of oil demand, demand from cars/buses and jet fuel demand for the airlines, are unlikely to seriously tick up before the autumn.

Now that OPEC and Russia have made their move, the rest of the support for the oil industry will have to come from elsewhere.

At today’s G20 meeting, it is possible that the other countries will be asked to either commit to lower production or to buy more oil for their strategic reserves to take some of the surplus out of the market.

The ball will be mainly in the courts of the largest producers, including Canada, Mexico, Brazil and the US.

Possibly the scariest US data at present, apart from the number of infected people, is the galloping increase in initial jobless numbers. On current count the last three weeks have brought 3.3m new jobless, then 6.8m and this week another 6.6m new job seekers.

Until the tide of job losses begins to turn there is no chance of the oil market changing trend either, other than on a very temporary basis, as the fundamental underlying domestic demand continues to be far less than pre-crisis levels.

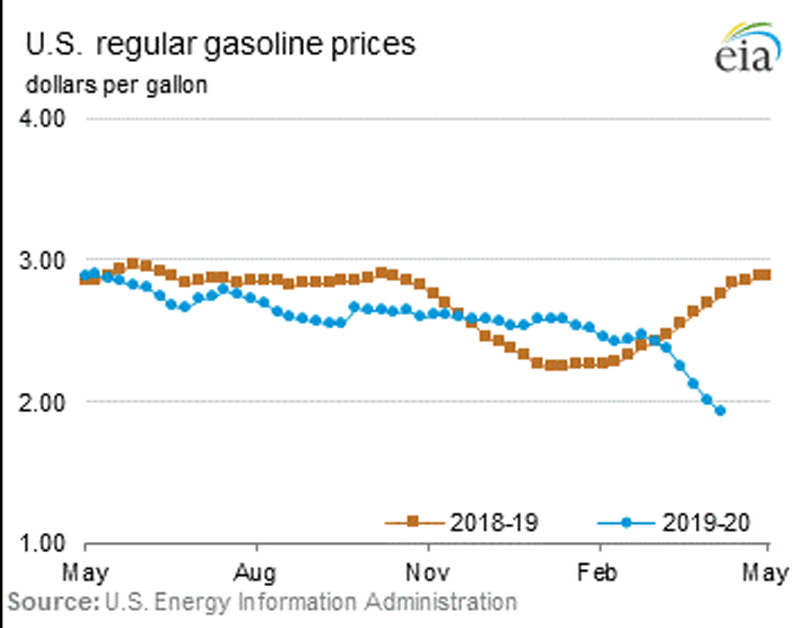

The Energy Information Administration’s report on Wednesday is likely to show a further decline in oil production and deeper destruction of domestic US demand.

Refinery utilisation rates have already dropped to 75.6%, down from 82.9% earlier this month and US crude oil refinery inputs thinned out by 1.3m bbl per day to average 13.6m bbl per day.

The number of rigs operating in the US has declined by almost 10% to 664, a loss of 361 rigs compared to the rig count a year ago. In the week ahead, look out for further news from producers, be it about abandoning future projects, shuttering parts of production or cutting jobs.

| When | What | Why is it important |

| Mon April 13 | Easter Monday | European and Australian markets closed |

| Mon April 13 | Russia budget fulfilment | If Russia’s budget shows a deficit it will be a red flag for the oil market requiring keeping a closer eye on Russia’s oil production decisions |

| Tue April 14 | China March trade data | It will show how much the country’s trade remained stymied in March because of corona |

| Tue April 14 20.30 | CFTC commitment of traders oil positions | Delayed data postponed because of Easter holidays |

| Tue April 14 21.30 | API US weekly crude oil stocks | Last at 11.938m |

| Wed April 15 13.15 | US March industrial production | First glimpse of the impact of virus lockdowns on US industrial production |

| Wed April 15 15.00 | EIA US crude oil stocks | Given the exceptionally fast rise in unemployment and shop closures expect an increase in unused stocks |

| Thu April 16 | OPEC monthly oil market report | Covers global demand and OPEC production in March |

| Thu April 16 13.30 | US initial jobless claims | Dreaded US jobless data showing full scale of the employment market destruction |

| Fri April 17 03.00 | China March industrial production | Expected to show improvement on Feb data as the production restarted post corona |

| Fri April 17 03.00 | China Q1 GDP | A glimpse of what kind of demand there will be from China once the world re-emerges from the pandemic |

| Fri April 17 18.00 | Baker Hughes US oil rig | Last week the count dropped by 64 to 664, down 361 y-o-y. Expect further declines |

| Fri April 17 20.30 | CFTC commitment of traders oil positions | Money managers’ oil positions |

©2025 GT Markets. All rights reserved.