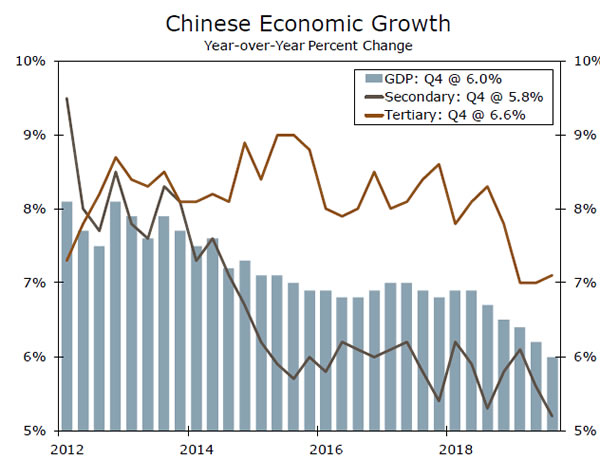

China after coronavirus: What Comes Next? The most significant Chinese data so far this year is released next week in the form of Q1 GDP.

China was the epicenter of the COVID- 19 outbreak, and given signals from extremely soft PMI surveys, as well as retail sales and industrial output, economic activity looks certain to have plunged in the first quarter.

We expect Q1 GDP decline some 10.0% quarter-over-quarter (close to the consensus), which would see Q1 GDP down 5.9% year-over-year.

China’s economy improved a bit in March as the outbreak eased, with the manufacturing and services PMI both jumping higher.

That said a complete recovery in activity is unlikely, with the consensus forecast for March retail sales to fall 10% and industrial output to fall 7.0%, both year-over-year.

Similarly, while we expect GDP growth to resume in Q2, we do not expect the first quarter losses to be fully recouped, and we forecast China’s GDP to fall 1.2% for full year 2020.

Investors are watching China for clues about how the global economy, and the U.S. economy specifically, will pick up once the spread of the coronavirus slows and lockdowns lift. They should be wary.

Official reports from the Chinese government, a set of closely followed purchasing managers’ indexes, recently showed that Chinese manufacturing and service-sector activity unexpectedly expanded in March after suffering the worst contractions on record in February. Some investors and economists found in the news reason to be optimistic

©2025 GT Markets. All rights reserved.